Increasing competitiveness - by open account credit terms delivery with usual maturity from 180 days

Possibility to draw funds immediately after delivery of goods in the receivable’s currency up to 100% of its nominal value

Reduction of operating costs - account receivables management is taken over by the factor

Factoring KB purchases receivables:

- without recourse to the supplier

- with recourse to the supplier

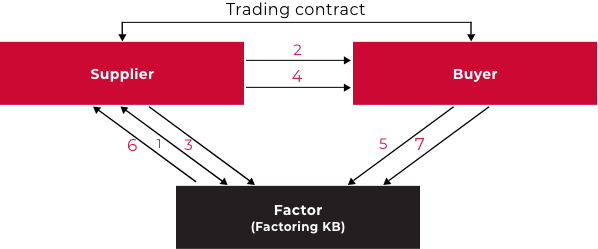

How it works

- Factoring KB concludes a framework agreement on assignment of receivables for consideration with or without recourse to the supplier.

- Supplier provides goods or services to the buyer.

- Supplier assigns the account receivable while providing the necessary documentation to Factoring KB.

- Supplier sends a Notice of Assignment of Receivable to the buyer.

- Buyer confirms the Notice of Assignment of Receivable (if the receivable has been assigned without recourse).

- Factoring KB pays to the supplier funds equal to 100% of the account receivable’s value

- Buyer pays the receivable in full to Factoring KB’s account.

In case the account receivable is not duly settled by the buyer on its due date, then (in the case of purchasing a receivable with recourse) the account receivable is returned to the supplier. Recourse means that the client is responsible for recoverability of the assigned receivables.

You might be interested

Who can apply for PURCHASE OF RECEIVABLES?

- trading, manufacturing, services or construction companies

- deliveries are one-time or repeated

- accounts receivable are before their due date

- there is no third party right to the accounts receivable

- there is a contractual relationship between the supplier and the buyer without ban on assignment of receivables

- minimum amount of purchased receivables is usually CZK 5 million

PURCHASE OF RECEIVABLES Advantages

- heightened competitive advantage due to providing goods, services or construction work through open account credit terms with maturity usually from 180 days; use of a payment schedule is possible

- possibility to draw funds immediately through overdraft option in the receivable’s currency equal to 100% of the nominal value

- in case the client has an account with KB, transfer of funds is possible on the same day of an account receivable’s assignment

- account receivables management taken over by the factor reduces operating costs

- improved financial indicators, as reduced amounts of accounts receivable are on the balance sheet

- possibilities of preparing the assignment of receivables already in pre-contract phases with the purpose of including the costs connected therewith into the delivered price

Costs associated with PURCHASE OF RECEIVABLES

Depending on circumstances of a given transaction, the price for the purchase of an account receivable is agreed individually. As part of the transaction, the following items are invoiced to the client (i.e. supplier):

- Factoring fee: includes cost connected with administering collection of the account receivable assigned to the factor.

- Discount: a fixed or floating rate (in % p.a.) derived from the reference rate valid as at the account receivable’s purchase date and increased by the factor’s margin. Discount means interest received in advance calculated from the purchase date to the due date of receivable.

The price for the assignment is usually set off against the nominal value of the assigned account receivable as at its assignment date.