Company Profile

- Established: 24 July 1997

- Operation started: 4 August 1997

- Equities: 1.184 billion CZK

- Shareholder: 100% Komerční banka

Board of Directors:

- Markéta Krýslová – Chairwoman of the Board of Directors

Supervisory Board:

- Radka Turková – Chairwoman of the Supervisory Board

- Jiří Šperl – Member of Supervisory Board

- Dominik Voříšek – Member of Supervisory Board

Since its establishment, Factoring KB is a part of Komerční banka Financial Group and belongs to Société Générale (SG) Group since 2002. This membership is essential for the company’s development and cooperation with other domestic and foreign group members. Factoring KB closely cooperates with Komerční banka on acquisitions and risk management but also in compliance area, human resources and IT.

Factoring KB, as an controlled entity, is a member of the Financial Group of Komerční banka, a.s. The managing person of the Komerční banka Financial Group concern is Komerční banka, a.s., with registered office at Na Příkopě 33, ZIP Code 114 07 Prague 1, ID number: 45317054.

Factoring KB is a member of one of the largest factoring organization networks in the world; Factors Chain International (FCI) which includes more than 400 members in over 90 countries globally. Factoring KB is one of the founding members of Association of Factoring Companies in the Czech Republic as well as a member of Czech Leasing and Financial Association.

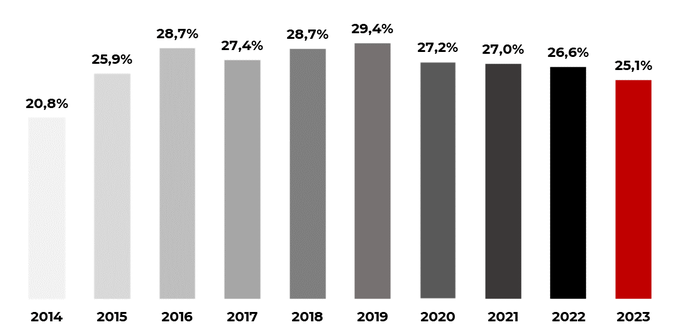

The development of the Czech market share of Factoring KB

Ten commandments of ethics

- In our business, we follow the principles of ethics and laws and regulations; we approach our trade partners and customers with respect. In the case of any violations, it is possible to report a whistleblowing alert. We guarantee the whistleblower complete anonymity and confidentiality.

Who is whistleblower

A person who performs or has performer work or other similar activity for Factoring KB, which means:

- Dependent work peformed in an employment relationship

- Sefl-employment

- Exercise of rights connected with participation in Factoring KB

- Performance of tasks within the scope of the activities of a legal entity, in its interest, on its behalf or on its account

- Volunteer activities

- Professional practice, internship

- Exercise of rights and obligations arising from a contract the subject of which is the provision of supplies, services, works or other similar performance.

Work or other similar activity includes applying for a job or other similar activity.

How to blow the whistle

Whistleblowing alert can be made:

- In writing – To the address of the company

Factoring KB, a.s.

Nám. Junkových 2772/1

Praha 5 150 00

indicate on the envelope „Whistleblowing – DO NOT OPEN“ - Through the internal whisteblowing systém in Factoring KB: whistleblowing@kb.cz and/or https://report.whistleb.com/en/fkb

- To the Competent Persons listed below, with whom you can arrange a personal meeting if necessary:

- Marcela Nouzová, Compliance Specialist, +420 602 950 533,

- Tomáš Choutka, Head of Regulatory Compliance, +420 602 575 927,

Common e-mail address of the Competent Persons to receive Whistleblowing alerts: whistleblowing@kb.cz.

For the purpose of further communication, please include your name, surname, date of birth or other information proving your identity in the Whistleblowing alert.

You may also make your Whistleblowing alert anonymously.

What are the next steps?

The whistleblower shall receive written confirmation of receipt of the Whistleblowing alert within 3 working days of its receipt at the latest. At the same time, the whistleblower will be informed whether or not his/her notification falls under the definition of notification pursuant to Act No 171/2023 Coll., on the Protection of Whistleblowers (hereinafter referred to as the "ZoOO") and what rights and obligations he/she is entitled to within this process. The information provided will be treated as strictly confidential.

The Competent Person will proceed with the investigation in such a way that the identity of the whistleblower is not disclosed. At all times during the investigation, the identity of the whistleblower will be known only to the Competent Persons. In the event that it is not possible to proceed with the investigation without disclosing the identity of the whistleblower to other persons, the Competent Person shall inform the whistleblower of this and seek his/her explicit consent to this procedure.

This does not apply in cases where the identity of the whistleblower is requested by public authorities. However, the Competent Person must inform the whistleblower of this fact in advance, together with the reasons for which it is obliged to provide the identity information, and give the whistleblower the opportunity to comment on the provision of the information.

The investigation will then assess the reasonableness of the Whistleblowing alert and other relevant facts. The Competent Person will then inform the whistleblower in writing of the results of this assessment within 30 days of receipt of the Whistleblowing alert. Where the matter is factually or legally complex, the Competent Person may extend this period by 30 days, up to a maximum of twice. In such cases, the Competent Person must always inform the whistleblower of the extension and the specific reasons for it.No acts of retaliation will be taken against the whistleblower if the Whistleblowing alert is made in good faith and without expectation of financial consideration. If the Whistleblowing alert meets the definition under Section 2(1) of the ZoOO, the whistleblower will be subject to the protections of this Act. In such a case, the Whistleblowing alert may also be made through the external notification system established by the Ministry of Justice. This does not apply in the case of facts that fall under the scope of Act No. 253/2008 Coll., on Certain Measures Against The Legalization of Proceeds of Crime And Terrorist Financing, where the competent authority for dealing with the notification is the Financial Analytical Office.

- We follow our internal documents that rely on the applicable and effective laws and regulations, the relevant acts of the European Union and the United Nations, and SG Group’s code of conduct (SG Code of Conduct).

- Société Générale Group Code of ConductPDF (881 kB) Download

- Société Généralé Group Tax Code of ConductPDF (190 kB) Download

- We take into account other companies’ rules of ethics and internal documents (if in the public domain and unless contrary to laws and regulations or the SG Code of Conduct), and we expect the same from our trade partners and customers.

- Société Générale Group Code of ConductPDF (881 kB) Download

- We do not support or tolerate fraudulent conduct, corruption, anti-competitive practices, discrimination, and harassment in any form. We fully respect SG Group’s code governing the fight against corruption and influence peddling.

- We do not accept or provide any unusual advantages of any kind.

- We prevent and prohibit potential conflicts of interests between personal activities and the job position.

- We do our best to prevent abuse of our services for any purposes of money laundering or terrorism financing and trading in arms, ammunition and other products and technologies that are classified as military material.

- Our conduct is apolitical and non-partisan; we do not support any action or initiative with an exclusively or predominantly political goal.

- In our commercial activities we respect the right to competition and competition law, being convinced that solely fair competition and transparent market can freely develop society as such.

- We care for the quality of the natural and social environment; under SG Group’s rules, we are scaling down the provision of financial products to areas having potentially adverse impacts.