Liquidity management

Strengthening of business relations with suppliers

Optimization of working capital

Advantages for buyers

- Optimization of working capital

- Strengthening of business relations with suppliers

- Liquidity management

Advantages for suppliers

- Liquidity management

- Maturity remains unchanged

- Payment of invoices on the due date

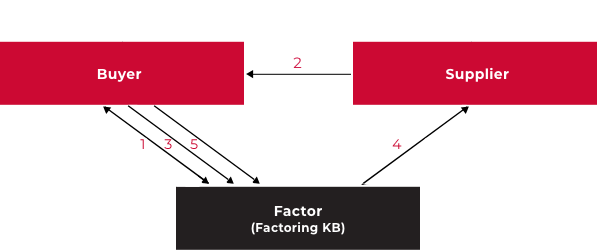

How does it work

- Factoring KB concludes an agreement with the Buyer on the financing of liabilities.

- The supplier supplies the goods or service to the Buyer together with the invoice.

- The buyer enters information about his liabilities in the eFactoring system and hands over the required documents to the Factor.

- Factoring KB pays the Supplier the invoice for the buyer on the due date or according to the Buyer's disposition.

- The buyer pays the obligation on the agreed maturity date to the KB Factoring account.

You might be interested

Who is the client of the liability financing product?

- A buyer in a business relationship who is interested in postponing the settlement of his business obligations beyond the agreed due date of supplier invoices.

Does it extend the due date for the supplier?

- No, the due date does not change, the relationship with the supplier is unchanged.

How does it work?

- On the due date, Factoring KB pays the invoice to the supplier instead of the buyer. The buyer then pays his financial obligation to the Factor at a later day, which is contractually agreed with the Factor.