Immediate possibility to draw funds in the account receivable currency

Funds transfer is possible on the same day as the assignment of the receivable

We will take over the management of your receivables and reduce your operating costs

Domestic recourse factoring

One of the forms of domestic factoring is recourse factoring. In practice it means that in case the account receivable is not paid in 90 days after the due date at the latest, it is reassigned to the client.

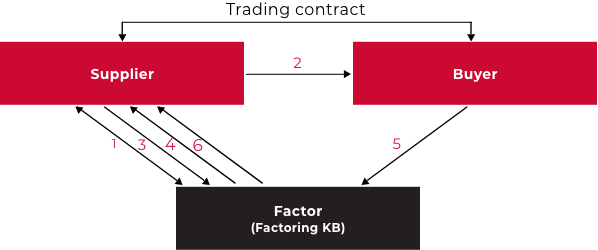

How it works

- Factoring KB concludes a domestic factoring agreement with the supplier.

- Supplier provides goods to the buyer including an invoice which contains assignment clause informing the buyer that the account receivable is assigned to Factoring KB.

- Supplier assigns account receivable with the necessary documentation to the factor (supplier has the option of electronic account receivable assignment).

- Factor pays so-called advance to the supplier in an amount of 70% to 90% of the account receivable value.

- Buyer pays account receivable in full to Factoring KB account.

- Based on the payment receipt, account receivable is settled with the supplier.

Domestic non-recourse factoring with insurance

Non-recourse factoring with insurance is another alternative. The advantage of this option assumes that Factoring KB handles all negotiations with the insurance company including applications for insurance limits and reporting of insurance events.

Insurance refers exclusively to cases of a domestic buyer’s financial insolvency. In case of insurance event, the client will receive 85% to 90% of the account receivable value; the remaining 15% (eventual 10%) represents the client’s participation on the risk.

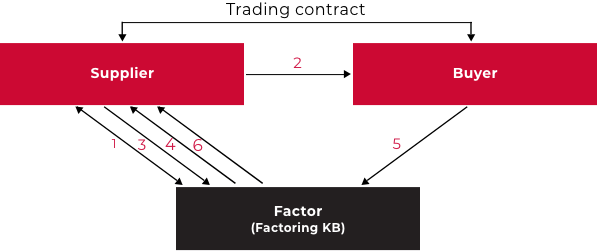

How it works

For this type of an agreement conclusion, determining insurance limit for selected buyers is essential.

- Factoring KB concludes a factoring agreement for domestic factoring with insurance with the supplier.

- Supplier provides goods to his buyer as a Factoring KB client.

- Supplier assigns account receivable (invoice with assignment clause) with the necessary documentation to the factor.

- Factor provides the client with advance payment based on contracted amount and reports the account receivable to the insurance company.

- Buyer pays the invoice amount to the factor’s account

- Based on the payment receipt, account receivable is settled with the supplier.

In case the account receivable is not paid in 90 days after the due date, the Factor reports an insurance event to the insurance company.

Domestic non-recourse factoring

A form of non-recourse factoring (without insurance) is also possible. In this case, Factoring KB, on behalf of the supplier in the domestic business, fully assumes the financial risk up to a pre-agreed amount. The risk is the inability or unwillingness of the customer to repay receivables (except for complaints and disputes).

How it works

- Factoring KB concludes a factoring agreement for domestic non-recourse factoring with the supplier.

- Supplier provides goods to his buyer as a Factoring KB client.

- Supplier assigns account receivable (invoice with assignment clause) with the necessary documentation to the factor.

- Factor provides the client with account receivable advance based on contracted amount.

- Buyer pays the invoice amount to the factor’s account.

- Based on the payment receipt, account receivable is settled with the supplier.

You might be interested

Who can apply for DOMESTIC FACTORING

- trading or manufacturing companies or entrepreneurs , that does business in the production, sale of goods or provide certain types of services

- the deliveries are regular

- goods or services are delivered to several regular buyers within open account credit term without securing by any bank instrument

- accounts receivable are before their due date

- there is no third-party right to the accounts receivable

- there is a contractual relation between the supplier and the buyer

- annual supply volume to the buyers through factoring is usually over CZK 10 million

DOMESTIC FACTORING Advantages

- increase of competitive advantage by providing goods through open account credit terms with maturity from 30 up to 120 days (180 days in exceptional cases)

- possibility to draw funds immediately through overdraft option in the account receivable currency, usually 70% to 90% of the nominal value

- pre-financing (advance) provided usually up to 24 hours from receiving account receivable documents (invoice, delivery note or handover protocol confirmed by the buyer)

- in case the client has an account with KB, funds transfer is possible on the same day of account receivable assignment

- goods sales volume extension through funding without the usual securing required by the banks

- planning specification and cash flow stabilization

- electronic communication allowing account receivable assignment and providing daily overview of accounts receivable, advances and collection

- account receivable management takeover by the factor-operating cost decrease

- interests based on actual provided funds

Costs associated with DOMESTIC FACTORING

- Factoring fee: Includes cost connected with administration, collection or insurance of accounts receivable assigned to the factor. Usually amounts to 0.1% to 0.8% of the account receivable value.

The price can be increased by premium in case of non-recourse factoring. - Interest: Interest is charged on advances provided for assigned accounts receivable based on short term bank credit rates.