Payment for delivered goods is made within 90 days upon receipt of the goods

Substantial operating cost decrease – not necessary to request issuing of letter of credit or bank’s guarantee

Supplier obtains funding and future income warranty

No financial charges towards the buyer arise from using this service as these are charged to the supplier. The only buyer obligation when using this service is to pay for the received goods directly to Factoring KB account.

Upon clients request Factoring KB can act as an intermediate party and provide factoring company in the country of the exporter with credit protection in order to conclude a factoring agreement with client’s supplier.

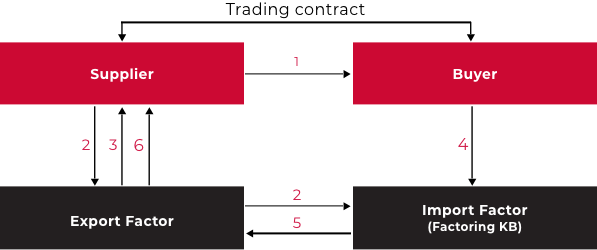

How it works

- Foreign supplier provides goods to his buyer in the Czech Republic including an invoice which contains assignment clause informing the buyer that respective account receivable is assigned to Factoring KB.

- Supplier assigns the account receivable to a factoring company in his country (Export Factor); that assigns such account receivable to Factoring KB.

- Export Factor pays the advance, usually in the amount of 70% to 90% of the account receivable value, to the supplier.

- Buyer pays the full value of the account receivable to Factoring KB account.

- Factoring KB remits the payment to Export Factor’s account.

- Upon payment receipt the account receivable account is settled between Export Factor and the supplier.

You might be interested

IMPORT FACTORING Advantages

- payment for delivered goods made within 90 days upon goods receipt

- buyer doesn’t have to request issuing of letter of credit or bank’s guarantee what results in the operating cost decrease

- supplier obtains funding and future income guarantees